Vaccinex Reports Third Quarter 2024 Financial Results and Provides Corporate Update

VCNX 11.18.2024

About Gravity Analytica

Treatment with pepinemab believed to slow cognitive decline due to Alzheimer’s disease:

- Treatment with Vaccinex’s pepinemab antibody to SEMA4D slowed expression of key biomarkers of disease progression, including blood levels of glial fibrillary acidic protein (GFAP) released by reactive astrocytes in brain, and phosphorylated tau peptide (p-tau 217), a byproduct of formation of toxic “tau tangles” in neurons. Changes in these biomarkers occur early in disease and reflect disease processes that are believed to lead to neuronal damage that compromises brain activity and cognition.

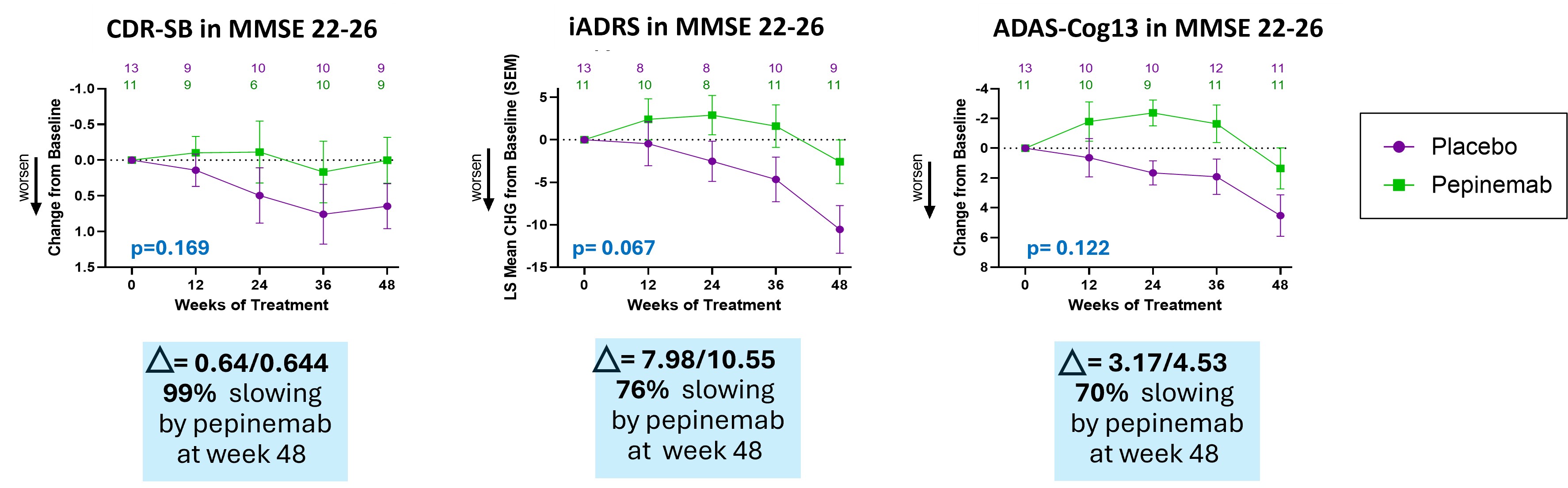

- Treatment with pepinemab after cognitive deficits become evident shows a consistent trend of slowing cognitive decline as determined by multiple established cognitive measures, CDR-SB, iADRS and ADAS-Cog13. This study was designed to test treatment effects at different stages of disease within the span of MCI and Mild Dementia. We found that biomarker and cognitive responses segregate among these groups, which had the effect of reducing group size and statistical significance. Nevertheless, the magnitude of cognitive improvement in patients who showed early signs of cognitive deficits (MMSE 22-26) was noteworthy.

Pepinemab treatment appears to slow cognitive decline improvementin patients who showed early signs of cognitive deficits (MMSE 22-26)

Treatment with pepinemab shows a consistent trend of slowing cognitive decline as determined by multiple established cognitive measures, CDR-SB, iADRS and ADAS-Cog13. Percent slowing is calculated using the formula: % slowing = ((Change with pepinemab – Change with placebo) / Change with placebo) * 100.

- These observations replicate and extend previous evidence of cognitive benefit in a larger prior study of pepinemab treatment in patients with Huntington’s disease, another neurodegenerative disease that is also characterized by astrocyte activation and neuroinflammation preceding cognitive decline. A statistically significant slowing of cognitive decline was observed for a randomized group of 180 patients in that study with a p-value of 0.007, improving even further (p=0.0025) in the subset of patients with early signs of cognitive deficits.

- The Company is encouraged by these similar findings in two different devastating neurodegenerative diseases that have parallel pathology and is actively pursuing partnering discussions to more rapidly advance further development.

- The SIGNAL-AD study was funded in part by investments from the Alzheimer’s

Drug Discovery Foundation (ADDF) and by a grant from the Alzheimer’s Association.

Treatment with pepinemab enhances immune activity in HPV-negative and PD-L1 low head and neck cancer (HNSCC), overcoming limitations of immune checkpoint therapy in these patient populations.

At the

Financial Results for the Quarter Ended

Cash and

On

On

Research and Development Expenses.Research and development expenses for the quarter ended

General and Administrative Expenses.General and administrative expenses for the quarter ended

Comprehensive loss/Net loss per share.The Comprehensive Loss and Net loss per share for the quarter ended

Total Stockholders’ Equity.On

For further details on Vaccinex’s financials, please refer to its Form 10K filed

About PepinemabPepinemab is a humanized IgG4 monoclonal antibody designed to block SEMA4D, which can trigger collapse of the actin cytoskeleton and loss of homeostatic functions of astrocytes and other glial cells in the brain and dendritic cells in immune tissue. Over 600 patients have been enrolled in randomized clinical trials of pepinemab in different indications and pepinemab appears to be well-tolerated with a favorable safety profile.

About Vaccinex Inc.

Vaccinex has global commercial and development rights to pepinemab and is the sponsor of the KEYNOTE-B84 study which is being performed in collaboration with Merck Sharp & Dohme Corp, a subsidiary of Merck and Co, Inc.

KEYTRUDA is a registered trademark of Merck Sharp & Dohme Corp., a subsidiary of

Forward Looking StatementsTo the extent that statements contained in this letter are not descriptions of historical facts regarding

Investor Contact

| Condensed Balance Sheets (Unaudited)(in thousands, except share and per share data) | ||||||||

| As of | As of | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 2,906 | $ | 1,535 | ||||

| Accounts receivable | 985 | 961 | ||||||

| Prepaid expenses and other current assets | 852 | 853 | ||||||

| Derivative asset | 14 | - | ||||||

| Total current assets | 4,757 | 3,349 | ||||||

| Property and equipment, net | 82 | 136 | ||||||

| Operating lease right-of-use asset | 15 | 146 | ||||||

| TOTAL ASSETS | $ | 4,854 | $ | 3,631 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 4,865 | $ | 2,039 | ||||

| Accrued expenses | 1,200 | 1,242 | ||||||

| Deferred revenue | 51 | 63 | ||||||

| Current portion of long-term debt | 44 | 75 | ||||||

| Operating lease liability | 15 | 146 | ||||||

| Warrant liability | - | 2,351 | ||||||

| Total current liabilities | 6,175 | 5,916 | ||||||

| Long-term debt | - | 26 | ||||||

| TOTAL LIABILITIES | 6,175 | 5,942 | ||||||

| Commitments and contingencies (Note 6) | ||||||||

| Stockholders’ equity (deficit): | ||||||||

| Convertible preferred stock (Series A), par value of | 1,522 | - | ||||||

| Common stock, par value of | 1 | - | ||||||

| Additional paid-in capital | 352,354 | 337,627 | ||||||

| (11 | ) | (11 | ) | |||||

| Accumulated deficit | (355,187 | ) | (339,927 | ) | ||||

| TOTAL STOCKHOLDERS’ EQUITY/(DEFICIT) | (1,321 | ) | (2,311 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 4,854 | $ | 3,631 | ||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | $ | 52 | $ | 20 | $ | 388 | $ | 570 | ||||||||

| Costs and expenses: | ||||||||||||||||

| Research and development | 3,165 | 4,355 | 10,412 | 13,217 | ||||||||||||

| General and administrative | 1,439 | 1,499 | 5,324 | 5,250 | ||||||||||||

| Total costs and expenses | 4,604 | 5,854 | 15,736 | 18,467 | ||||||||||||

| Loss from operations | (4,552 | ) | (5,834 | ) | (15,348 | ) | (17,897 | ) | ||||||||

| Interest expense | - | - | - | (1 | ) | |||||||||||

| Loss on settlement of warrants | (1,106 | ) | - | (1,106 | ) | - | ||||||||||

| Financing costs - warrant liabilities | - | - | (28 | ) | - | |||||||||||

| Change in fair value of warrant liabilities | (71 | ) | - | 1,291 | - | |||||||||||

| Change in fair value of derivative asset | - | - | (81 | ) | - | |||||||||||

| Other income (expense), net | (3 | ) | 922 | 12 | 964 | |||||||||||

| Loss before provision for income taxes | (5,732 | ) | (4,912 | ) | (15,260 | ) | (16,934 | ) | ||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| Net loss attributable to | $ | (5,732 | ) | $ | (4,912 | ) | $ | (15,260 | ) | $ | (16,934 | ) | ||||

| Comprehensive loss | $ | (5,732 | ) | $ | (4,912 | ) | $ | (15,260 | ) | $ | (16,934 | ) | ||||

| Net loss per share attributable to | $ | (2.83 | ) | $ | (15.25 | ) | $ | (8.85 | ) | $ | (59.95 | ) | ||||

| Weighted-average shares used in computing net loss per share attributable to | 2,026,920 | 322,153 | 1,724,088 | 282,467 | ||||||||||||

A photo accompanying this announcement is available athttps://www.globenewswire.com/NewsRoom/AttachmentNg/551b0bc4-4495-4a65-aa21-a96daddf079e

Pepinemab treatment appears to slow cognitive decline improvement in patients who showed early signs of cognitive deficits (MMSE 22-26)

Treatment with pepinemab shows a consistent trend of slowing cognitive decline as determined by multiple established cognitive measures, CDR-SB, iADRS and ADAS-Cog13. Percent slowing is calculated using the formula: % slowing = ((Change with pepinemab – Change with placebo) / Change with placebo) * 100.

Source: Vaccinex, Inc.