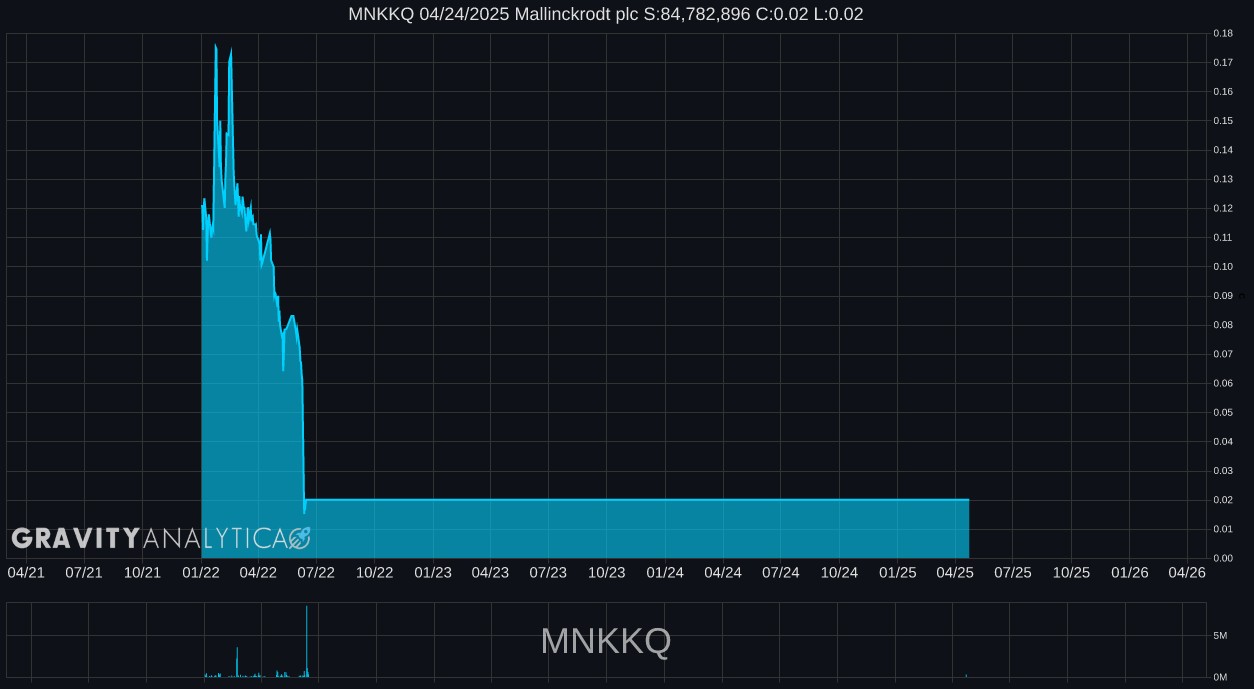

Mallinckrodt plc Reports Third Quarter 2024 Financial Results and Raises Full Year Guidance

MNKKQ 11.05.2024

Drug:NONE-NONE Acthar Gel

Drug:NONE-NONE INOmax

Drug:NONE-NONE Terlivaz

About Gravity Analytica

Achieves Third Quarter

Reaffirms Full Year Net Sales Guidance and Raises Full Year Adjusted EBITDA Guidance After Adjusting Both Metrics for the Therakos Transaction

Successfully Launched Acthar Gel SelfJectTM Device and Expanded the Rollout of INOmax®EVOLVETM DS Delivery System to

Specialty Generics Segment Maintains Momentum with

Net Proceeds from Sale of

"Our third quarter results demonstrate the successful execution of our strategy to stabilize the base business and position Mallinckrodt for long-term growth. We are pleased to reaffirm our full year net sales guidance and again raise our Adjusted EBITDA guidance, even after adjusting for the

ThirdQuarter 2024 Financial Results1

Mallinckrodt's net sales in the third quarter of 2024 were

The Company's Specialty Brands segment reported net sales of

Mallinckrodt's Specialty Generics segment reported net sales of

The Company's net loss for the third quarter was

Mallinckrodt's Adjusted EBITDA in the third quarter was

Gross profit as a percentage of net sales was 43.7% for the third quarter, as compared to 30.3% for the third quarter of 2023. Adjusted gross profit as a percentage of net sales was 65.4% for the third quarter, as compared to 66.3% for the third quarter of 2023.

Mallinckrodt's cash balance at the end of the third quarter of 2024 was

NineMonth 2024 Results1

Mallinckrodt's net sales were

The Company recorded a net loss of

Mallinckrodt's Adjusted EBITDA was

ThirdQuarter 2024 Business Segment Update

Specialty Brands

Acthar Gelnet sales were

Terlivaznet sales were

INOmax (nitric oxide) gasnet sales in the third quarter were

As previously announced, the Company entered into a definitive agreement to sell the

Specialty Generics

TheSpecialty Genericssegment reported year-over-year net sales growth of 4.1% in the third quarter of 2024. These results were driven by strong performance in finished-dosage products and increased demand for Controlled Substance APIs, slightly offset by softness in the APAP business stemming from excess supply in the broader market.

Net sales in the Specialty Generics segment have grown for the past seven quarters, and its third quarter performance is particularly notable given the strong comparable quarter in 2023, which was driven by the launch of lisdexamfetamine dimesylate capsules (generic form of Vyvanse®).

Please see "Non-GAAP Financial Measures" included in this release for a discussion of non-GAAP measures and reconciliation of GAAP and non-GAAP financial measures for the third quarter.

Please see the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of the Company's Quarterly Report on Form 10-Q for the quarter ended

2024Financial Guidance Update

Mallinckrodt today reaffirmed its net sales guidance and raised its Adjusted EBITDA guidance for full year 2024.

The Company's updated guidance assumes that the

The Company's updated guidance is as follows:

Updated 2024 Guidance | Prior 2024 Guidance | |

Total | $1.9 billion to | |

Adjusted EBITDA | $590 million to |

Mallinckrodt notes that for full year 2024

The Company does not provide the comparable GAAP measures for its forward-looking non-GAAP guidance or a reconciliation of such measures because the reconciling items described in the definition of Adjusted EBITDA provided below are inherently uncertain and difficult to estimate and cannot be predicted without unreasonable effort. The variability of such items may have a significant impact on our future GAAP results.

1As a result of emerging from Chapter 11, the three and nine months ended |

Conference Call and Webcast

Mallinckrodt will hold a conference call today,

- Live Call Participant Registration (including dial-in):https://register.vevent.com/register/BI60bb36abdb99465c9db5640f3457528a

- Audio Only Webcast Link (live and replay):https://edge.media-server.com/mmc/p/6tqaksqg/

- At the Mallinckrodt website:https://ir.mallinckrodt.com/

About Mallinckrodt

Mallinckrodt is a global business consisting of multiple wholly owned subsidiaries that develop, manufacture, market and distribute specialty pharmaceutical products and therapies. The Company's Specialty Brands reportable segment's areas of focus include autoimmune and rare diseases in specialty areas like neurology, rheumatology, hepatology, nephrology, pulmonology, ophthalmology and oncology; immunotherapy and neonatal respiratory critical care therapies; analgesics; and gastrointestinal products. Its Specialty Generics reportable segment includes specialty generic drugs and active pharmaceutical ingredients. To learn more about Mallinckrodt, visitwww.mallinckrodt.com.

Mallinckrodt uses its website as a channel of distribution of important company information, such as press releases, investor presentations and other financial information. It also uses its website to expedite public access to time-critical information regarding the Company in advance of or in lieu of distributing a press release or a filing with the

NON-GAAP FINANCIAL MEASURES

This press release contains financial measures, including Adjusted EBITDA, adjusted gross profit, adjusted selling, general, and administrative ("SG&A") expenses, adjusted research and development ("R&D") expenses, net sales growth (loss) on a constant-currency basis, and net debt, which are considered "non-GAAP" financial measures under applicable

Adjusted EBITDA represents net income or loss prepared in accordance with accounting principles generally accepted in the

The Company has forecasted a full-year 2024 adjusted EBITDA for

Adjusted gross profit, adjusted SG&A expenses and adjusted R&D expenses represent amounts prepared in accordance with GAAP, adjusted for certain items that management believes are not reflective of the operational performance of the business. Adjustments to GAAP amounts include, as applicable to each measure, the aforementioned items in the Adjusted EBITDA paragraph. The adjustments for these items are on a pre-tax basis for adjusted gross profit and adjusted SG&A expenses.

Segment net sales growth (loss) on a constant-currency basis measures the change in segment net sales between current- and prior-year periods using a constant currency, the exchange rate in effect during the applicable prior-year period.

Net debt of

The Company has provided these adjusted financial measures because they are used by management, along with financial measures in accordance with GAAP, to evaluate the Company's operating performance and liquidity. In addition, the Company believes that they will be used by investors to measure Mallinckrodt's operating results. Management believes that presenting these adjusted measures provides useful information about the Company's performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance.

These adjusted measures should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company's definition of these adjusted measures may differ from similarly titled measures used by others.

Because adjusted financial measures exclude the effect of items that will increase or decrease the Company's reported results of operations, management strongly encourages investors to review the Company's unaudited condensed consolidated financial statements and publicly filed reports in their entirety. A reconciliation of certain of these historical adjusted financial measures to the most directly comparable GAAP financial measures is included in the tables accompanying this release.

Further information regarding non-GAAP financial measures can be found on the Investor Relations page of the Company's website.

Predecessor and Successor Periods

Mallinckrodt's financial results presented in this press release include Successor and Predecessor periods. The Successor period runs for the three and nine months ended

Mallinckrodt's results of operations as reported in its unaudited condensed consolidated financial statements for the Successor and Predecessor periods are in accordance with GAAP. The comparison of the Predecessor and Successor periods for the periods presented here is not in accordance with GAAP. However, the Company believes that the comparison is useful for management and investors to assess Mallinckrodt's ongoing financial and operational performance and trends.

CAUTIONARY STATEMENTS RELATED TO FORWARD-LOOKING STATEMENTS

Statements in this press release that are not strictly historical, including statements regarding future financial condition and operating results, expected product launches, legal, economic, business, competitive and/or regulatory factors affecting Mallinckrodt's businesses, the ongoing strategic review, and any other statements regarding events or developments Mallinckrodt believes or anticipates will or may occur in the future, may be "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve a number of risks and uncertainties.

There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include risks and uncertainties related to, among other things: the parties' ability to satisfy the conditions to the divestiture of the

The "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Mallinckrodt's Annual Report on Form 10-K for the fiscal year ended

CONTACTS

Investor Relations

MediaMichael Freitag / Aaron Palash / Aura Reinhard /

Mallinckrodt, the "M" brand mark and the

MALLINCKRODT PLC | ||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||

(unaudited, in millions, except per share data) | ||||||

Successor | Predecessor | |||||

Three MonthsEnded | Three MonthsEnded | |||||

Percent of Net sales | Percent of Net sales | |||||

Net sales | $ 505.5 | 100.0 % | $ 497.0 | 100.0 % | ||

Cost of sales | 284.4 | 56.3 | 346.2 | 69.7 | ||

Gross profit | 221.1 | 43.7 | 150.8 | 30.3 | ||

Selling, general and administrative expenses | 141.2 | 27.9 | 129.2 | 26.0 | ||

Research and development expenses | 28.2 | 5.6 | 25.7 | 5.2 | ||

Restructuring charges, net | 0.1 | — | (0.1) | — | ||

Non-restructuring impairment charges | — | — | 135.9 | 27.3 | ||

Liabilities management and separation costs | 15.2 | 3.0 | 142.1 | 28.6 | ||

Operating income (loss) | 36.4 | 7.2 | (282.0) | (56.7) | ||

Interest expense | (59.0) | (11.7) | (133.1) | (26.8) | ||

Interest income | 7.4 | 1.5 | 3.4 | 0.7 | ||

Other (expense) income, net | (3.8) | (0.8) | 9.1 | 1.8 | ||

Reorganization items, net | — | — | (1,311.5) | (263.9) | ||

Loss from continuing operations before income taxes | (19.0) | (3.8) | (1,714.1) | (344.9) | ||

Income tax expense | 7.2 | 1.4 | 10.8 | 2.2 | ||

Loss from continuing operations | (26.2) | (5.2) | (1,724.9) | (347.1) | ||

(Loss) income from discontinued operations, net of income taxes | — | — | 0.1 | — | ||

Net loss | $ (26.2) | (5.2) % | $ (1,724.8) | (347.0) % | ||

Basic and diluted (loss) income per share: | ||||||

Loss from continuing operations | $ (1.33) | $ (128.61) | ||||

(Loss) income from discontinued operations | — | — | ||||

Net loss | $ (1.33) | $ (128.60) | ||||

Weighted-average number of shares outstanding | ||||||

Basic and diluted | 19.7 | 13.4 | ||||

MALLINCKRODT PLC | ||||||||||

CONSOLIDATED ADJUSTED EBITDA | ||||||||||

(unaudited, in millions) | ||||||||||

Successor | Predecessor | |||||||||

Three MonthsEnded | Three MonthsEnded | |||||||||

Grossprofit | SG&A | R&D | AdjustedEBITDA | Grossprofit | SG&A | R&D | AdjustedEBITDA | |||

Net loss | $ 221.1 | $ 141.2 | $ 28.2 | $ (26.2) | $ 150.8 | $ 129.2 | $ 25.7 | |||

Adjustments: | ||||||||||

Interest expense, net | — | — | — | 51.6 | — | — | — | 129.7 | ||

Income tax expense | — | — | — | 7.2 | — | — | — | 10.8 | ||

Depreciation | 7.5 | (0.5) | (0.2) | 8.2 | 9.3 | (1.6) | (0.5) | 11.4 | ||

Amortization | 18.1 | — | — | 18.1 | 125.6 | — | — | 125.6 | ||

Restructuring and related charges, net | — | — | — | 0.1 | — | — | — | (0.1) | ||

Non-restructuring impairment charge | — | — | — | — | — | — | — | 135.9 | ||

Income from discontinued operations | — | — | — | — | — | — | — | (0.1) | ||

Change in contingent consideration fair value | — | (1.1) | — | 1.1 | — | 0.2 | — | (0.2) | ||

Change in derivative asset & liabilities fair value | — | — | — | 1.9 | — | — | — | — | ||

Liabilities management and separation costs(1) | — | — | — | 15.2 | — | — | — | 142.1 | ||

Unrealized loss on equity investment | — | — | — | 1.3 | — | — | — | (7.2) | ||

Reorganization items, net(2) | — | 0.2 | — | (0.2) | — | — | — | 1,311.5 | ||

Share-based compensation | — | 1.4 | 0.1 | (1.5) | — | (2.3) | (0.1) | 2.4 | ||

Fresh-start inventory-related expense(3) | 83.8 | — | — | 83.8 | 43.6 | — | — | 43.6 | ||

As adjusted: | $ 330.5 | $ 141.2 | $ 28.1 | $ 160.6 | $ 329.3 | $ 125.5 | $ 25.1 | $ 180.6 | ||

(1) | Represents costs included in SG&A, primarily related to expenses incurred related to professional fees and costs incurred as we explored potential sales of non-core assets to enable further deleveraging post-emergence from the 2023 bankruptcy proceedings during the three months ended |

(2) | As of |

(3) | Represents inventory step-up amortization of |

MALLINCKRODT PLC | ||||

SEGMENT OPERATING INCOME | ||||

(unaudited, in millions) | ||||

Successor | Predecessor | |||

Three Months Ended | Three MonthsEnded | |||

Specialty Brands(1) | $ 51.6 | $ 87.6 | ||

Specialty Generics(2) | 52.0 | 64.0 | ||

Segment operating income | 103.6 | 151.6 | ||

Unallocated amounts: | ||||

Corporate and unallocated expenses(3) | (27.1) | (16.3) | ||

Depreciation and amortization | (26.3) | (137.0) | ||

Share-based compensation | 1.5 | (2.4) | ||

Restructuring charges, net | (0.1) | 0.1 | ||

Non-restructuring impairment charge | — | (135.9) | ||

Liabilities management and separation costs(4) | (15.2) | (142.1) | ||

Operating income (loss) | $ 36.4 | $ (282.0) | ||

(1) | Includes |

(2) | Includes |

(3) | Includes administration expenses and certain compensation, legal, environmental and other costs not charged to the Company's reportable segments. |

(4) | Represents costs included in SG&A, primarily related to expenses incurred related to professional fees and costs incurred as we explored potential sales of non-core assets to enable further deleveraging post-emergence from the 2023 bankruptcy proceedings during the three months ended |

MALLINCKRODT PLC | ||||||||||

SEGMENT NET SALES AND CONSTANT-CURRENCY GROWTH | ||||||||||

(unaudited, in millions) | ||||||||||

Successor | Predecessor | Non-GAAP Measure | ||||||||

Three MonthsEnded | Three MonthsEnded | Percent change | Currencyimpact | Constant-currency(loss) growth | ||||||

Specialty Brands | $ 286.0 | $ 286.2 | (0.1) % | — % | (0.1) % | |||||

Specialty Generics | 219.5 | 210.8 | 4.1 | — % | 4.1 | |||||

Net sales | $ 505.5 | $ 497.0 | 1.7 % | — % | 1.7 % | |||||

MALLINCKRODT PLC | ||||||||||

SELECT PRODUCT LINE NET SALES AND CONSTANT-CURRENCY GROWTH | ||||||||||

(unaudited, in millions) | ||||||||||

Successor | Predecessor | Non-GAAP Measure | ||||||||

Three MonthsEnded | Three MonthsEnded | Percent change | Currencyimpact | Constant-currencygrowth (loss) | ||||||

Specialty Brands | ||||||||||

Acthar Gel | $ 126.4 | $ 122.1 | 3.5 % | — % | 3.5 % | |||||

INOmax | 64.0 | 72.9 | (12.2) | — | (12.2) | |||||

67.6 | 66.0 | 2.4 | 0.2 | 2.2 | ||||||

Amitiza | 18.8 | 18.3 | 2.7 | — | 2.7 | |||||

Terlivaz | 7.3 | 4.4 | 65.9 | — | 65.9 | |||||

Other | 1.9 | 2.5 | (24.0) | (3.2) | (20.8) | |||||

Specialty Brands Total | 286.0 | 286.2 | (0.1) | — | (0.1) | |||||

Specialty Generics | ||||||||||

Opioids | 85.9 | 65.9 | 30.3 | — | 30.3 | |||||

ADHD | 41.3 | 41.5 | (0.5) | — | (0.5) | |||||

Addiction treatment | 18.1 | 15.1 | 19.9 | (0.1) | 20.0 | |||||

Other | 0.9 | 3.4 | (73.5) | — | (73.5) | |||||

Generics | 146.2 | 125.9 | 16.1 | — | 16.1 | |||||

Controlled substances | 27.2 | 22.0 | 23.6 | — | 23.6 | |||||

APAP | 40.0 | 57.4 | (30.3) | — | (30.3) | |||||

Other | 6.1 | 5.5 | 10.9 | — | 10.9 | |||||

API | 73.3 | 84.9 | (13.7) | — | (13.7) | |||||

Specialty Generics | 219.5 | 210.8 | 4.1 | — | 4.1 | |||||

Net sales | $ 505.5 | $ 497.0 | 1.7 % | — % | 1.7 % | |||||

MALLINCKRODT PLC | ||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||

(unaudited, in millions, except per share data) | ||||||

Successor | Predecessor | |||||

Nine MonthsEnded | Nine Months Ended | |||||

Percent of Net sales | Percent of Net sales | |||||

Net sales | $ 1,487.6 | 100.0 % | $ 1,396.6 | 100.0 % | ||

Cost of sales | 907.5 | 61.0 | 1,091.1 | 78.1 | ||

Gross profit | 580.1 | 39.0 | 305.5 | 21.9 | ||

Selling, general and administrative expenses | 406.0 | 27.3 | 369.6 | 26.5 | ||

Research and development expenses | 85.3 | 5.7 | 83.0 | 5.9 | ||

Restructuring charges, net | 10.5 | 0.7 | 0.9 | 0.1 | ||

Non-restructuring impairment charges | — | — | 135.9 | 9.7 | ||

Liabilities management and separation costs | 32.2 | 2.2 | 157.3 | 11.3 | ||

Operating income (loss) | 46.1 | 3.1 | (441.2) | (31.6) | ||

Interest expense | (177.5) | (11.9) | (457.7) | (32.8) | ||

Interest income | 20.2 | 1.4 | 12.8 | 0.9 | ||

Other expense, net | (3.6) | (0.2) | (6.7) | (0.5) | ||

Reorganization items, net | — | — | (1,321.1) | (94.6) | ||

Loss from continuing operations before income taxes | (114.8) | (7.7) | (2,213.9) | (158.5) | ||

Income tax expense | 20.4 | 1.4 | 508.1 | 36.4 | ||

Loss from continuing operations | (135.2) | (9.1) | (2,722.0) | (194.9) | ||

Income from discontinued operations, net of income taxes | 0.3 | — | 0.1 | — | ||

Net loss | $ (134.9) | (9.1) % | $ (2,721.9) | (194.9) % | ||

Basic and diluted (loss) income per share: | ||||||

Loss from continuing operations | $ (6.86) | $ (205.37) | ||||

Income from discontinued operations | 0.02 | 0.01 | ||||

Net loss | $ (6.85) | $ (205.37) | ||||

Weighted-average number of shares outstanding: | ||||||

Basic and diluted | 19.7 | 13.3 | ||||

MALLINCKRODT PLC | ||||||||||

CONSOLIDATED ADJUSTED EBITDA | ||||||||||

(unaudited, in millions) | ||||||||||

Successor | Predecessor | |||||||||

Nine MonthsEnded | Nine MonthsEnded | |||||||||

Grossprofit | SG&A | R&D | AdjustedEBITDA | Grossprofit | SG&A | R&D | AdjustedEBITDA | |||

Net loss | $ 580.1 | $ 406.0 | $ 85.3 | $ (134.9) | $ 305.5 | $ 369.6 | $ 83.0 | |||

Adjustments: | ||||||||||

Interest expense, net | — | — | — | 157.3 | — | — | — | 444.9 | ||

Income tax expense | — | — | — | 20.4 | — | — | — | 508.1 | ||

Depreciation | 24.9 | (1.4) | (0.9) | 27.2 | 27.9 | (5.7) | (1.5) | 35.1 | ||

Amortization | 66.3 | — | — | 66.3 | 388.1 | — | — | 388.1 | ||

Restructuring and related charges, net | — | 2.5 | — | 8.0 | — | — | — | 0.9 | ||

Non-restructuring impairment charges | — | — | — | — | — | — | — | 135.9 | ||

Income from discontinued operations | — | — | — | (0.3) | — | — | — | (0.1) | ||

Change in contingent consideration fair value | — | (3.2) | — | 3.2 | — | 7.3 | — | (7.3) | ||

Change in derivative asset & liabilities fair value | — | — | — | 5.9 | — | — | — | — | ||

Liabilities management and separation costs(1) | — | — | — | 32.2 | — | — | — | 157.3 | ||

Unrealized (gain) loss on equity investment | — | — | — | (1.4) | — | — | — | 9.1 | ||

Reorganization items, net(2) | — | (4.5) | — | 4.5 | — | — | — | 1,321.1 | ||

Share-based compensation | 0.1 | (3.6) | (0.1) | 3.8 | — | (7.4) | (0.3) | 7.7 | ||

Fresh-start inventory-related expense(3) | 293.7 | — | — | 293.7 | 169.2 | — | — | 169.2 | ||

Recovery of bad debt - customer bankruptcy | — | 6.4 | — | (6.4) | — | — | — | — | ||

As adjusted: | $ 965.1 | $ 402.2 | $ 84.3 | $ 890.7 | $ 363.8 | $ 81.2 | $ 448.1 | |||

(1) | Represents costs included in SG&A, primarily related to expenses incurred related to professional fees and costs incurred as we explored potential sales of non-core assets to enable further deleveraging post-emergence from the 2023 bankruptcy proceedings during the nine months ended |

(2) | As of |

(3) | Represents |

MALLINCKRODT PLC | ||||

SEGMENT OPERATING INCOME | ||||

(unaudited, in millions) | ||||

Successor | Predecessor | |||

Nine MonthsEnded | Nine MonthsEnded | |||

Specialty Brands(1) | $ 97.2 | $ 181.6 | ||

Specialty Generics(2) | 152.6 | 131.9 | ||

Segment operating income | 249.8 | 313.5 | ||

Unallocated amounts: | ||||

Corporate and unallocated expenses(3) | (70.1) | (29.7) | ||

Depreciation and amortization | (93.5) | (423.2) | ||

Share-based compensation | (3.8) | (7.7) | ||

Restructuring charges, net | (10.5) | (0.9) | ||

Non-restructuring impairment charges | — | (135.9) | ||

Liabilities management and separation costs(4) | (32.2) | (157.3) | ||

Recovery of bad debt - customer bankruptcy | 6.4 | — | ||

Operating income (loss) | $ 46.1 | $ (441.2) | ||

(1) | Includes |

(2) | Includes |

(3) | Includes administration expenses and certain compensation, legal, environmental and other costs not charged to our reportable segments. |

(4) | Represents costs included in SG&A, primarily related to expenses incurred related to professional fees and costs incurred as we explored potential sales of non-core assets to enable further deleveraging post-emergence from the 2023 bankruptcy proceedings during the nine months ended |

MALLINCKRODT PLC | ||||||||||

SEGMENT NET SALES AND CONSTANT-CURRENCY GROWTH | ||||||||||

(unaudited, in millions) | ||||||||||

Successor | Predecessor | Non-GAAP Measure | ||||||||

Nine MonthsEnded | Nine MonthsEnded | Percent change | Currencyimpact | Constant-currency(loss) growth | ||||||

Specialty Brands | $ 817.8 | $ 818.3 | (0.1) % | — % | (0.1) % | |||||

Specialty Generics | 669.8 | 578.3 | 15.8 | — | 15.8 | |||||

Net sales | $ 1,487.6 | $ 1,396.6 | 6.5 % | — % | 6.5 % | |||||

MALLINCKRODT PLC | ||||||||||

SELECT PRODUCT LINE NET SALES AND CONSTANT-CURRENCY GROWTH | ||||||||||

(unaudited, in millions) | ||||||||||

Successor | Predecessor | Non-GAAP Measures | ||||||||

Nine MonthsEnded | Nine MonthsEnded | Percent change | Currencyimpact | Constant-currencygrowth (loss) | ||||||

Specialty Brands | ||||||||||

Acthar Gel | $ 346.9 | $ 320.9 | 8.1 % | — % | 8.1 % | |||||

INOmax | 200.6 | 232.5 | (13.7) | — | (13.7) | |||||

193.0 | 187.6 | 2.9 | 0.1 | 2.8 | ||||||

Amitiza | 53.5 | 61.4 | (12.9) | — | (12.9) | |||||

Terlivaz | 18.6 | 10.0 | 86.0 | — | 86.0 | |||||

Other | 5.2 | 5.9 | (11.9) | (4.7) | (7.2) | |||||

Specialty Brands Total | 817.8 | 818.3 | (0.1) | — | (0.1) | |||||

Specialty Generics | ||||||||||

Opioids | 263.0 | 200.2 | 31.4 | — | 31.4 | |||||

ADHD | 114.8 | 82.9 | 38.5 | — | 38.5 | |||||

Addiction treatment | 54.5 | 46.8 | 16.5 | (0.1) | 16.6 | |||||

Other | 6.0 | 7.6 | (21.1) | — | (21.1) | |||||

Generics | 438.3 | 337.5 | 29.9 | — | 29.9 | |||||

Controlled substances | 76.5 | 61.4 | 24.6 | — | 24.6 | |||||

APAP | 139.0 | 163.6 | (15.0) | — | (15.0) | |||||

Other | 16.0 | 15.8 | 1.3 | — | 1.3 | |||||

API | 231.5 | 240.8 | (3.9) | — | (3.9) | |||||

Specialty Generics | 669.8 | 578.3 | 15.8 | — | 15.8 | |||||

Net sales | $ 1,487.6 | $ 1,396.6 | 6.5 % | — % | 6.5 % | |||||

MALLINCKRODT PLC | |||

CONDENSED CONSOLIDATED BALANCE SHEETS | |||

(unaudited, in millions) | |||

Successor | |||

Assets | |||

Current Assets: | |||

Cash and cash equivalents | $ 410.5 | $ 262.7 | |

Accounts receivable, net | 383.3 | 377.5 | |

Inventories | 710.6 | 982.7 | |

Prepaid expenses and other current assets | 169.2 | 138.9 | |

Current assets held for sale | 49.3 | — | |

Total current assets | 1,722.9 | 1,761.8 | |

Property, plant and equipment, net | 361.7 | 321.7 | |

Intangible assets, net | 433.7 | 608.4 | |

Deferred income taxes | 777.1 | 801.0 | |

Long-term assets held for sale | 115.3 | — | |

Other assets | 227.0 | 240.7 | |

Total Assets | $ 3,637.7 | $ 3,733.6 | |

Liabilities and Shareholders' Equity | |||

Current Liabilities: | |||

Current maturities of long-term debt | $ 8.7 | $ 6.5 | |

Accounts payable | 84.5 | 100.4 | |

Accrued payroll and payroll-related costs | 90.0 | 82.8 | |

Accrued interest | 45.0 | 20.1 | |

Acthar Gel-Related Settlement | 21.3 | 21.5 | |

Accrued and other current liabilities | 280.1 | 269.9 | |

Current liabilities held for sale | 24.1 | — | |

Total current liabilities | 553.7 | 501.2 | |

Long-term debt | 1,731.8 | 1,755.9 | |

Acthar Gel-Related Settlement | 121.8 | 128.5 | |

Pension and postretirement benefits | 38.6 | 40.6 | |

Environmental liabilities | 34.4 | 35.1 | |

Other income tax liabilities | 25.7 | 19.6 | |

Long-term liabilities held for sale | 3.2 | — | |

Other liabilities | 100.2 | 92.5 | |

Total Liabilities | 2,609.4 | 2,573.4 | |

Shareholders' Equity: | |||

Ordinary A shares, €1.00 par value, 25,000 authorized; none issued and outstanding | — | — | |

Ordinary shares, | 0.2 | 0.2 | |

Additional paid-in capital | 1,198.4 | 1,194.6 | |

Accumulated other comprehensive income | 2.8 | 3.6 | |

Retained deficit | (173.1) | (38.2) | |

Total Shareholders' Equity | 1,028.3 | 1,160.2 | |

Total Liabilities and Shareholders' Equity | $ 3,637.7 | $ 3,733.6 | |

MALLINCKRODT PLC | ||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||

(unaudited, in millions) | ||||

Successor | Predecessor | |||

Nine MonthsEnded | Nine MonthsEnded | |||

Cash Flows From Operating Activities: | ||||

Net loss | $ (134.9) | $ (2,721.9) | ||

Adjustments to reconcile net cash from operating activities: | ||||

Depreciation and amortization | 93.5 | 423.2 | ||

Share-based compensation | 3.8 | 7.7 | ||

Deferred income taxes | 22.9 | 475.5 | ||

Non-cash impairment charges | — | 135.9 | ||

Reorganization items, net | — | 1,294.1 | ||

Non-cash (amortization) accretion expense | (3.6) | 176.7 | ||

Other non-cash items | 18.9 | 11.6 | ||

Changes in assets and liabilities: | ||||

Accounts receivable, net | (16.5) | (23.8) | ||

Inventories | 222.1 | 99.1 | ||

Accounts payable | (5.6) | (31.2) | ||

Income taxes | (7.1) | 168.7 | ||

Opioid-Related Litigation Settlement Liability | — | (250.0) | ||

Acthar-Gel-Related Settlement | (21.4) | (16.5) | ||

Other | 13.6 | (46.8) | ||

Net cash from operating activities | 185.7 | (297.7) | ||

Cash Flows From Investing Activities: | ||||

Capital expenditures | (71.5) | (41.9) | ||

Proceeds from divestitures, net of cash | — | — | ||

Proceeds from debt and equity securities | 22.6 | — | ||

Other | 4.2 | 1.1 | ||

Net cash from investing activities | (44.7) | (40.8) | ||

Cash Flows From Financing Activities: | ||||

Issuance of external debt | — | 380.0 | ||

Repayment of debt | (4.4) | (52.0) | ||

Debt financing costs | — | (2.4) | ||

Other | (0.4) | (0.1) | ||

Net cash from financing activities | (4.8) | 325.5 | ||

Effect of currency rate changes on cash | (0.6) | (1.7) | ||

Net change in cash, cash equivalents and restricted cash, including cash classified within assets held for sale | 135.6 | (14.7) | ||

Less: Net change in cash classified within assets held for sale | (3.0) | — | ||

Net change in cash, cash equivalents and restricted cash | 132.6 | (14.7) | ||

Cash, cash equivalents and restricted cash at beginning of period | 343.4 | 466.7 | ||

Cash, cash equivalents and restricted cash at end of period | $ 476.0 | $ 452.0 | ||

Cash and cash equivalents at end of period | $ 410.5 | $ 389.8 | ||

Restricted cash included in prepaid expenses and other current assets at end of period | 23.9 | 22.9 | ||

Restricted cash included in other long-term assets at end of period | 41.6 | 39.3 | ||

Cash, cash equivalents and restricted cash at end of period | $ 476.0 | $ 452.0 | ||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mallinckrodt-plc-reports-third-quarter-2024-financial-results-and-raises-full-year-guidance-302296022.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mallinckrodt-plc-reports-third-quarter-2024-financial-results-and-raises-full-year-guidance-302296022.html

SOURCE Mallinckrodt plc