Aptorum Group Limited Reports Financial Results and Business Update for the Six Months Ended June 30, 2024

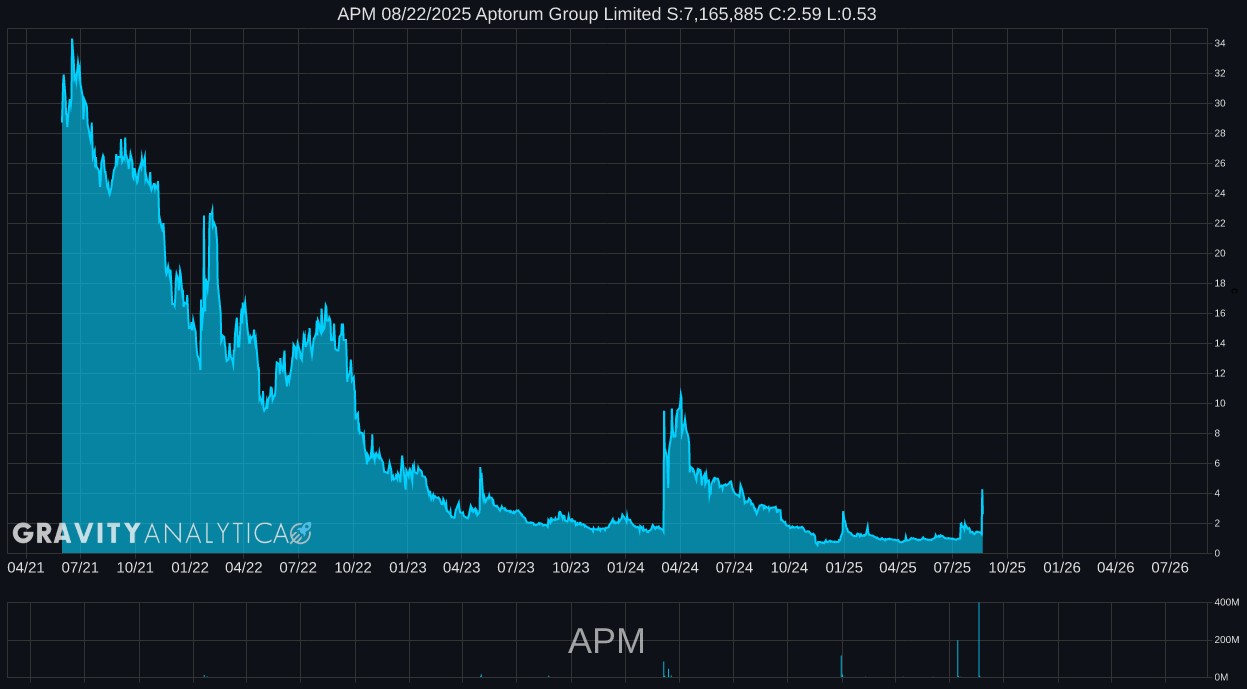

APM 12.20.2024

About Gravity Analytica

Recent News

- 01.02.2025 - Aptorum Group Limited Announces Pricing of $3.0 Million Registered Direct Offering

- 12.20.2024 - Aptorum Group Limited Reports Financial Results and Business Update for the Six Months Ended June 30, 2024

- 04.30.2024 - Aptorum Group Limited Reports 2023 Fiscal Year End Financial Results and Provides Business Update

Recent Filings

“Our team and Yoov have spent considerable time and effort on the due diligence process, the negotiation of definitive terms, and the preparation of necessary transactional and listing documentation. However, current market conditions have introduced significant uncertainty regarding the availability of the required funding for the transaction. After careful consideration, our Board has determined that it is no longer in the best interests of our shareholders to proceed with this transaction. Despite this, we will continue to explore other business combination opportunities that we believe will enhance shareholder value,” stated Mr.

Corporate Highlights

On

Financial Results for the Six Months Ended

Research and development expenses were

General and administrative fees were

Legal and professional fees were

As of

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Stated in | ||||||||

ASSETS | ||||||||

Current assets: | ||||||||

Cash | $ | 783,085 | $ | 2,005,351 | ||||

Accounts receivable | 21,800 | 47,709 | ||||||

Amounts due from related parties | 3,595 | 961 | ||||||

Other receivables and prepayments | 725,616 | 422,071 | ||||||

Total current assets | 1,534,096 | 2,476,092 | ||||||

Property and equipment, net | - | 1,663,926 | ||||||

Operating lease right-of-use assets | - | 182,057 | ||||||

Long-term investments | 16,098,846 | 16,098,846 | ||||||

Intangible assets, net | - | 147,347 | ||||||

Long-term deposits | 71,823 | 71,823 | ||||||

Total Assets | $ | 17,704,765 | $ | 20,640,091 | ||||

LIABILITIES AND EQUITY | ||||||||

LIABILITIES | ||||||||

Current liabilities: | ||||||||

Amounts due to related parties | $ | 79,180 | $ | 79,180 | ||||

Accounts payable and accrued expenses | 1,148,235 | 1,894,341 | ||||||

Operating lease liabilities, current | 89,145 | 125,232 | ||||||

Total current liabilities | 1,316,560 | 2,098,753 | ||||||

Operating lease liabilities, non-current | 62,718 | 99,485 | ||||||

Convertible notes to a related party | 3,148,500 | 3,058,500 | ||||||

Total Liabilities | $ | 4,527,778 | $ | 5,256,738 | ||||

Commitments and contingencies | - | - | ||||||

EQUITY | ||||||||

Class A Ordinary Shares ( | $ | 37 | $ | 31 | ||||

Class B Ordinary Shares ( | 18 | 22 | ||||||

Additional paid-in capital | 93,470,186 | 93,018,528 | ||||||

Accumulated other comprehensive loss | (9,762 | ) | (10,623 | ) | ||||

Accumulated deficit | (70,805,518 | ) | (68,161,722 | ) | ||||

Total equity attributable to the shareholders of | 22,654,961 | 24,846,236 | ||||||

Non-controlling interests | (9,477,974 | ) | (9,462,883 | ) | ||||

Total equity | 13,176,987 | 15,383,353 | ||||||

Total Liabilities and Equity | $ | 17,704,765 | $ | 20,640,091 | ||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS For the six months ended (Stated in | ||||||||

For the six months ended | ||||||||

2024 | 2023 | |||||||

Revenue | ||||||||

Healthcare services income | $ | - | $ | 431,378 | ||||

Operating expenses | ||||||||

Costs of healthcare services | - | (426,063 | ) | |||||

Research and development expenses | (2,038,923 | ) | (3,212,366 | ) | ||||

General and administrative fees | (326,187 | ) | (1,263,019 | ) | ||||

Legal and professional fees | (366,164 | ) | (1,738,566 | ) | ||||

Other operating expenses | (137,233 | ) | (330,212 | ) | ||||

Total operating expenses | (2,868,507 | ) | (6,970,226 | ) | ||||

Other income (expenses) | ||||||||

Loss on investments in marketable securities, net | - | (9,266 | ) | |||||

Interest expense, net | (68,462 | ) | (93,478 | ) | ||||

Loss on disposal of subsidiaries | (4,271 | ) | - | |||||

Sundry income | 282,353 | 36,803 | ||||||

Total other income (expenses), net | 209,620 | (65,941 | ) | |||||

Net loss | $ | (2,658,887 | ) | $ | (6,604,789 | ) | ||

Less: net loss attributable to non-controlling interests | (15,091 | ) | (1,117,685 | ) | ||||

Net loss attributable to | $ | (2,643,796 | ) | $ | (5,487,104 | ) | ||

Net loss per share – basic and diluted | $ | (0.50 | ) | $ | (1.43 | ) | ||

Weighted-average shares outstanding – basic and diluted | 5,339,608 | 3,849,621 | ||||||

Net loss | $ | (2,658,887 | ) | $ | (6,604,789 | ) | ||

Other comprehensive income (loss) | ||||||||

Exchange differences on translation of foreign operations | 861 | (7,485 | ) | |||||

Other comprehensive income (loss) | 861 | (7,485 | ) | |||||

Comprehensive loss | (2,658,026 | ) | (6,612,274 | ) | ||||

Less: comprehensive loss attributable to non-controlling interests | (15,091 | ) | (1,117,685 | ) | ||||

Comprehensive loss attributable to the shareholders of | (2,642,935 | ) | (5,494,589 | ) | ||||

About

For more information about the Company, please visitwww.aptorumgroup.com.

Disclaimer and Forward-Looking Statements

This press release does not constitute an offer to sell or a solicitation of offers to buy any securities of

This press release includes statements concerning

These forward-looking statements speak only as of the date of this press release and are subject to a number of risks, uncertainties and assumptions including, without limitation, risks related to its announced management and organizational changes, the continued service and availability of key personnel, its ability to expand its product assortments by offering additional products for additional consumer segments, development results, the company’s anticipated growth strategies, anticipated trends and challenges in its business, and its expectations regarding, and the stability of, its supply chain, and the risks more fully described in Aptorum Group’s Form 20-F and other filings that

This press release is provided “as is” without any representation or warranty of any kind.

View source version onbusinesswire.com:https://www.businesswire.com/news/home/20241220907803/en/

Source: